Some of the scariest words that exist are:

You’ve been served.

Your heart starts racing, sweat pops out, you might even feel like you want to throw up.

Oh wait. That’s just TV. The reality is, the sheriff and private process servers don’t actually say that. Well, maybe once in a while but not often.

Still, the reaction to being served with legal papers, whether that’s a lawsuit against you or your company, an eviction notice, or something else entirely, isn’t a comforting experience. What you’ve been handed or been sent by certified mail or had taped to your front door determines how you must respond to it. And make no mistake, you must respond to it.

To make matters worse, sometimes it’s pretty hard to tell what that bunch of papers actually is.

Okay, I need to define a legal term for this post. The act of being handed a bunch of legal documents that you have to respond to is called being “served.” So, when I say a document has been “served” I mean that a specific set of legal paperwork has gone through the necessary steps to be given to someone in a particular way so that the person has to respond to that paper work in a specific manner in a specific way. I know I left that definition pretty vague but the type of paperwork, what the steps are, how it has to be given to a person, and how that person has to respond changes depending on the specifics. The main point is once you’ve been “served” you generally need to do something fairly specific fairly fast. From papers for business lawyers to a domestic dispute, the process remains the same. So, let me try to make that less vague with an example.

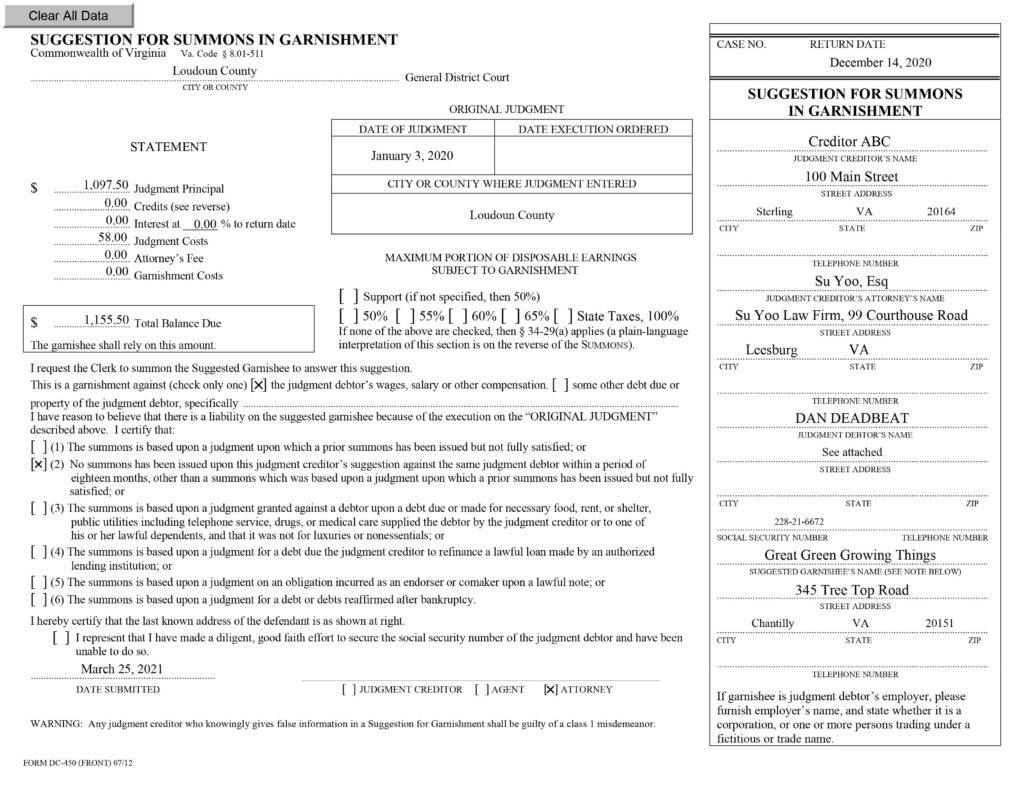

Great Growing Green Things (“GGGT”) was served with a document that looked something like this:

The document came with an instruction sheet and an “Answer” that needed to be filed with the Court. Since the response date was months away, GGGT wasn’t sure how Creditor ABC got judgment against it or what it had been for, but GGGT just assumed it had missed something. As the date got closer, GGGT started getting worried about it and had just decided to pay the $1,550.50 Creditor ABC wanted. A business associate of GGGT suggested talking to an attorney because when GGGT confided in her, the situation didn’t seem to make sense.

When GGGT talked to us as business lawyers, we explained that GGGT didn’t actually owe Creditor ABC any money. The paperwork GGGT was served with was a “Garnishment,” which meant a lot to us, but nothing to GGGT. Okay, legal mumbo jumbo time again.

A garnishment is a special kind of lawsuit where a creditor attempts to collect money a person (called a “Debtor”) owes it from a third-party that owes money to the Debtor. This is something that business lawyers need to handle on a fairly regular basis. As a “simplified” example, Joker and Penguin pull a heist and Penguin steals Joker’s gold deck of cards. Joker sues Penguin and gets a judgment against Penguin for $500, the value of the cards. Now Joker needs to collect the judgment. Joker knows Penguin banks with First Metropolis Bank so Joker sues or “garnishes” First Metropolis Bank asking it to pay any money that Penguin has on deposit with the bank to Joker up to the $500 judgment amount (and any costs of the garnishment and interest). If Penguin’s bank account has money in it, First Metropolis will give Joker the money in the account up to the amount of the judgment debt.

In GGGT’s case, Creditor ABC hadn’t gotten a judgment against GGT but against Dan Deadbeat (the “Debtor”). Instead, Creditor ABC was asking GGGT if it owed Dan Deadbeat any wages from September 16,2020 (the date GGGT was “served” – December 14, 2020 (the Court date) and if so, GGGT was required to pay the amount of those wages (to the extent they were above the minimum wage) to Creditor ABD rather than Dan Deadbeat. A quick check of GGGT’s records showed that Dan Deadbeat never worked for it. While we couldn’t figure out why Creditor ABC thought Dan was GGGT’s employee or contractor, we didn’t care. A quick consultation with an attorney about what the documents GGGT had been served with saved it close to $1,400.

If you’ve been served, it’s critical to figure out what you’ve been served with, how long you have to respond and the best response for you.

Interested on our services?

If you would like assistance with this or any other compliance matter, please contact Nancy at N D Greene PC by clicking on schedule an appointment.

SCHEDULE AN APPOINTMENT